Cukup satu aplikasi kamu bisa Investasi Reksa Dana, SBN, Emas dan Asuransi di tanamduit, mudah dan praktis!

tanamduit berizin dan diawasi:

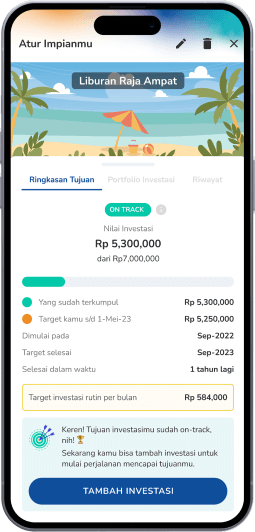

Capai Tujuan Investasi

Liburan ke Raja Ampat

bukan cuma mimpi!

Fitur Tanam Mimpi membantu kamu mencapai target keuangan sesuai dengan waktu yang direncanakan melalui investasi rutin di tanamduit.

Nikmati kemudahan:

Tips budgeting

Top 3 Reksa Dana Performa Terbaik

Reminder investasi rutin

Pantau mimpi kamu on-track/off-track

Capai tujuan investasi

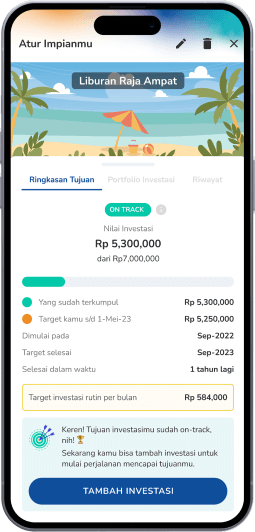

Liburan ke Raja Ampat

bukan cuma mimpi!

Fitur Tanam Mimpi membantu kamu mencapai target keuangan sesuai dengan waktu yang direncanakan melalui investasi rutin di tanamduit.

Nikmati kemudahan:

Tips budgeting

Top 3 Reksa Dana Performa Terbaik

Reminder investasi rutin

Pantau mimpi kamu on-track/off-track

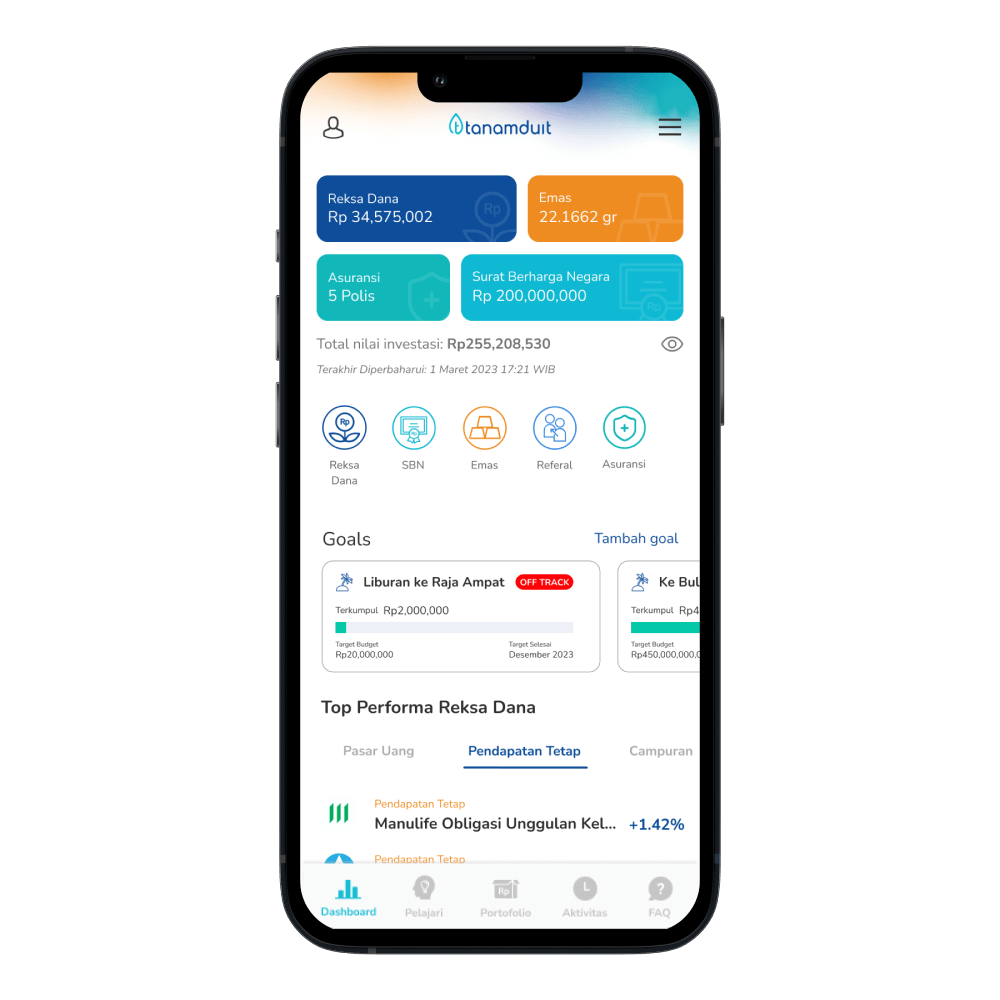

Aplikasi Investasi tanamduit menyediakan

Aplikasi Investasi tanamduit menyediakan

Aplikasi Investasi Serba bisa Investasi online di tanamduit itu

Praktis!

Lihat portofolio investasi

dan asuransi kamu

dalam satu jendela.

Aman!

Sistem kemanan aplikasi

investasi dengan pin,

sidik jari dan face id.

Lengkap!

Investasi reksa dana

sampai asuransi

lewat satu aplikasi.

MUDAH!

Transaksi investasi dengan

beragam metode

pembayaran.

Apa kata mereka tentang tanamduit?

Promo Spesial untuk Kamu!

Selalu ada kejutan buat kamu di tanamduit.

Yuk tingkatkan terus investasimu & Dapatkan banyak promo menarik!

Mitra Pembayaran

![]()

Tunggu apa lagi?

Download aplikasi tanamduit dan

Amankan masa depanmu sekarang!

Tunggu apa lagi?

Download aplikasi tanamduit dan

Amankan masa depanmu sekarang!

Tunggu apa lagi?

Download aplikasi tanamduit dan

Amankan masa depanmu sekarang!

Masih punya banyak pertanyaan?

Yuk, kita cari tahu

bersama sama

Kunjungi blog tanamduit untuk

belajar seputar dunia finansial bersama kami!

FAQ

Apa itu tanamduit?

tanamduit adalah aplikasi investasi yang menyediakan ragam pilihan investasi online, mulai dari reksa dana, Surat Berharga Negara (SBN) ritel, emas, hingga asuransi. Selain itu, tanamduit juga merupakan aplikasi investasi terpercaya karena sudah diawasi OJK.

Bagaimana cara berinvestasi di tanamduit?

Kamu dapat menginstall terlebih dahulu aplikasi tanamduit di Google Playstore (android) atau App Store (iOS), kemudian lengkapi data diri sampai proses verifikasi. Sambil menunggu proses verifikasi, kamu bisa pelajari cara investasi online di tanamduit melalui dashboard pada bagian “Cara bertanamduit”. Setelah proses verifikasi akunmu selesai, kamu sudah bisa memulai perjalanan investasimu di tanamduit!

Investasi apa saja yang ada di tanamduit?

Kami menyediakan pilihan lengkap produk investasi yang terdiri dan reksa dana, Surat Berharga Negara (SBN) ritel, dan emas.

OTP Tidak Masuk di Email Saya

Kamu dapat memeriksa OTP di folder Spam di email kamu jika kamu tidak menemukannya di folder Inbox. Jika kamu sudah memeriksanya dan masih belum menemukan, silahkan hubungi customer service tanamduit untuk mendapatkan bantuan.

Adakah Biaya untuk Berinvestasi di tanamduit?

Biaya yang mungkin timbul pada saat bertransaksi adalah biaya transfer antar Bank yang diatur oleh kebijakan masing-masing Bank.

PT Mercato Digital Asia Dilindungi Undang-Undang

tanamduit adalah platform finansial digital atau aplikasi investasi terpercaya yang menyediakan berbagai instrumen investasi dan asuransi dalam satu aplikasi.

tanamduit dimiliki oleh PT Mercato Digital Asia yang telah terdaftar pada Kementerian Komunikasi dan Informatika (KOMINFO) dengan nomor: 005445.01/DJAI.PSE/07/2022.

PT Mercato Digital Asia bekerja sama dengan PT Cipta Optima Digital (emasin) untuk produk Koleksi Emas dan PT Emas Digital Global (Tamasia) dalam menyediakan produk emas 24 Karat produksi emas PT Aneka Tambang Tbk (Antam).

Produk Surat Berharga Negara (SBN) difasilitasi oleh PT Star Mercato Capitale, sebagai anak usaha PT Mercato Digital Asia. PT Star Mercato Capitale telah berizin dan diawasi oleh Otoritas Jasa Keuangan (OJK) dengan nomor KEP-13/PM.21/2017 dan Surat penunjukan mitra distribusi dari DJPPR - Kementerian Keuangan Republik Indonesia dengan nomor S-363/pr/2018 dan dari SBSN dengan nomor PENG-2/PR.4/2018.

Produk asuransi disediakan oleh PT Mercato Digital Insurtech bekerja sama dengan Premiro yang telah memiliki izin OJK dengan nomor KEP. 18/NB.1/2016.

—

Penting untuk diperhatikan! Transaksi investasi reksa dana, emas, dan Surat Berharga Negara (SBN) tanamduit hanya dapat dilakukan di aplikasi tanamduit. Pastikan tidak melakukan transaksi investasi di luar aplikasi tanamduit dan/ataupun melakukan transfer dana ke rekening atas nama pribadi. Jaga kerahasiaan data pribadi untuk menghindari penipuan mengatasnamakan tanamduit.